Have you ever felt that twinge of doubt when investing your hard-earned money? I recall my first foray into the world of investment; it felt like walking on a tightrope. This post addresses one such investment opportunity that has raised eyebrows: Kennedy Funding. As you consider this venture, let’s unravel the mystery together. What’s the reality behind the claims of it being a ripoff?

What is Kennedy Funding?

If you’re exploring commercial real estate financing, you might have heard of Kennedy Funding. But what exactly is it? Let’s break it down.

Overview of Kennedy Funding’s Services

Kennedy Funding specializes in providing loans for commercial real estate. They focus on projects that traditional banks often overlook. This includes high-risk loans that can be essential for investors looking to seize unique opportunities.

They offer a variety of services, primarily revolving around:

- Bridge Loans: Short-term financing solutions to bridge the gap until permanent financing is secured.

- Construction Loans: Funding for new construction projects, allowing investors to get started without delay.

- Refinancing Options: Helping property owners refinance existing loans for better terms or cash-out options.

Historical Context of the Company

Founded in 1993, Kennedy Funding has carved out a niche in the commercial lending market. Over the years, it has built a reputation for funding non-traditional investment opportunities. This has set them apart from conventional lenders who often shy away from risks.

Think about it: many investors are eager to take on projects that may be seen as too risky for banks. Kennedy Funding steps in to fill that gap, providing essential capital for these ventures.

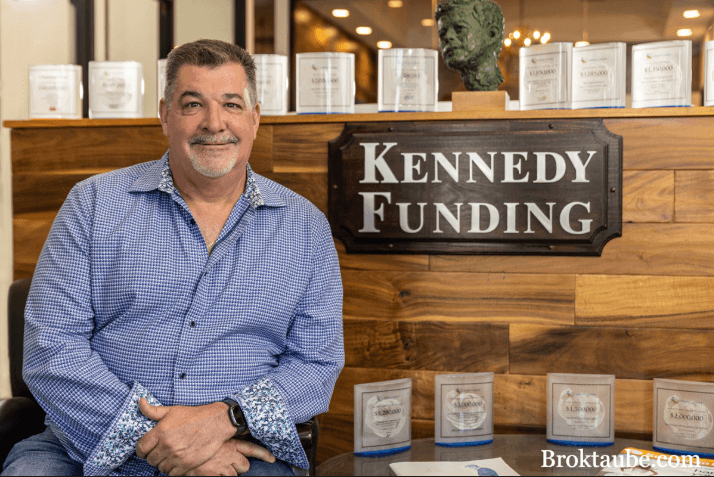

Key Executives and Their Backgrounds

Leadership plays a crucial role in any company. At Kennedy Funding, experienced professionals drive the vision and strategy. The key executives bring a wealth of knowledge and expertise to the table.

For instance, the founder has decades of experience in finance and real estate. This background helps the company navigate the complexities of commercial loans. Their insights guide the team in making sound lending decisions.

Types of Loans Offered

As mentioned earlier, Kennedy Funding offers various loan types tailored to meet different needs. Here’s a quick overview:

- High-Risk Loans: These loans are designed for projects that may not qualify for traditional financing.

- Short-Term Financing: Ideal for investors needing quick access to capital.

- Non-Recourse Loans: Loans where the borrower is not personally liable, minimizing risk for investors.

Market Position and Competition

In the competitive landscape of commercial lending, Kennedy Funding holds a unique position. They cater to clients who seek financing options beyond what banks typically offer. This includes those involved in:

- Real estate development

- Renovation projects

- Acquisition of properties

While there are other lenders in the market, Kennedy Funding’s focus on high-risk opportunities allows them to stand out. They are often the go-to choice for investors who are looking to take calculated risks.

Investors and Due Diligence

As with any investment, caution is key. Jane Doe, a financial advisor, emphasizes this point:

“Investors must perform due diligence before committing their funds.”

This is particularly true with Kennedy Funding, where the projects may carry higher risks.

Before diving into any investment, it’s crucial to assess the potential rewards against the risks. Understanding the terms of the loan and the nature of the project can help you make informed decisions.

Conclusion

In summary, Kennedy Funding plays a vital role in the commercial real estate market. Their focus on high-risk loans opens doors for many investors. Whether you’re looking to finance a new project or refinance an existing loan, they provide options that traditional banks may not. As you consider your financing choices, remember to weigh your options carefully.

Allegations Against Kennedy Funding

Summary of Major Complaints

Many customers have voiced their frustrations with Kennedy Funding. The most common issues include:

- Unresponsive customer service: Clients often report long wait times and unanswered calls.

- Unexpected fees: Borrowers have mentioned hidden charges that were not disclosed upfront.

- Delayed loan processing: Many claim that their applications took longer than promised, leading to financial strain.

These complaints paint a troubling picture of a company that seems to struggle with customer satisfaction. You might wonder, how can a financial institution operate effectively with so many unresolved issues?

Consumer Testimonials and Stories

Real stories from consumers provide insight into the experiences with Kennedy Funding. One borrower shared:

“I felt like I was in a never-ending loop. I reached out for help, but no one ever got back to me.” – Anonymous

Such testimonials illustrate the emotional toll that financial hardships can take. When you’re relying on a loan, the last thing you need is a lack of support.

Case Studies of Failed Loans

Several case studies have emerged that highlight the challenges faced by borrowers. For example:

- Case Study 1: A small business owner applied for a loan to expand their operations. After weeks of waiting, they were denied without clear reasoning.

- Case Study 2: An individual seeking funds for medical expenses encountered unexpected fees that doubled the initial loan amount.

These cases raise questions about the transparency and fairness of Kennedy Funding’s loan processes. Can you trust a lender that doesn’t clearly communicate its terms?

Legal Actions Taken Against Kennedy Funding

Over the years, Kennedy Funding has faced various legal challenges. Some lawsuits allege deceptive practices and breach of contract. For instance, a group of borrowers filed a class-action lawsuit, claiming they were misled about the terms of their loans.

Legal actions like these can tarnish a company’s reputation. When you consider borrowing from a lender, wouldn’t you want to know if they’ve been involved in legal disputes?

Analysis of Online Reviews and Ratings

Online reviews provide a mixed bag of opinions about Kennedy Funding. On platforms like Yelp and Trustpilot, you’ll find:

- Positive reviews: Some customers praise the quick funding process and helpful representatives.

- Negative reviews: Many users highlight issues with customer service and hidden fees.

It’s crucial to seek out verified review sites to ensure authenticity. As John Smith, a consumer advocate, wisely stated,

“When facing a financial crisis, it’s crucial to know whom to trust.”

This advice rings true, especially when considering a loan provider.

Conclusion

The reputation of Kennedy Funding has come under fire for various consumer grievances. With numerous complaints about unresponsive customer service and unexpected fees, potential borrowers should proceed with caution. Before making any financial commitments, it’s wise to conduct thorough research and consider the experiences of others.

Expert Opinions on Investment Risks

Insights from Financial Analysts

Financial analysts play a critical role in guiding investors through the often turbulent waters of the investment world. They provide insights based on extensive research and data analysis. But what exactly do they look at? Analysts examine market trends, economic indicators, and company performance. They help you understand where to put your money and what to avoid. Their expertise can be invaluable, especially when the market is unpredictable.

Risk Factors Investors Should Watch Out For

Investing is not without its risks. Here are some key factors you should keep an eye on:

- Market Volatility: Prices can swing dramatically in short periods. This can lead to significant gains or losses.

- Economic Conditions: Recessions or economic downturns can impact your investments. Always stay informed about the economic climate.

- Company Performance: If a company is struggling, your investment could suffer. Regularly check their financial health.

- Sector Risks: Certain sectors may be more prone to risks than others. For example, tech stocks can be more volatile than utility stocks.

Tips for Protecting Your Investment

Protecting your investment is crucial. Here are some strategies to consider:

- Diversification: Spread your investments across different asset classes. This can help reduce risk.

- Stay Informed: Keep up with financial news and market trends. Knowledge is power.

- Set Realistic Goals: Understand what you want to achieve with your investments. This will guide your decisions.

- Consult Experts: Don’t hesitate to seek advice from financial experts. They can provide tailored guidance.

Understanding Risk Tolerance

Every investor has a different risk tolerance. This is your ability and willingness to take on risk in your investments. Understanding this is key to making informed decisions. Ask yourself: How much can I afford to lose? and How would I feel if my investments dropped significantly? Knowing your risk tolerance helps you choose the right investment strategy.

The Impact of Scams on Financial Markets

Financial scams are a significant concern for investors. They can undermine trust in the markets. Scams can take many forms, from Ponzi schemes to fake investment opportunities. Being aware of these scams is crucial. Knowledgeable investors can recognize safe opportunities and avoid falling prey to fraudulent schemes.

“Every investment comes with risk; educating yourself reduces the likelihood of falling victim to scams.” – Expert Economist

Understanding the landscape of investment risks is essential. Not all high-risk investments are scams; understanding the difference is key. For example, a startup may be risky but not fraudulent. Conversely, a seemingly safe investment could be a scam. This is where expert advice becomes paramount in navigating investment decisions.

In today’s financial environment, scams are rampant. But with the right knowledge, you can protect yourself. Stay informed and remain vigilant. The more you learn, the better equipped you’ll be to make wise investment choices.

Remember, investing is a journey. The more you understand, the more confident you’ll feel. So, take the time to educate yourself. It’s an investment in itself.

Consumer Protection and Rights

Understanding Your Rights as a Consumer

As a consumer, you have rights. But do you know what they are? Many people don’t. This lack of knowledge can leave you vulnerable. It’s essential to understand your rights to protect yourself from scams and unfair practices. In the U.S., laws like the Fair Credit Reporting Act and the Truth in Lending Act are designed to safeguard consumers. These laws ensure that you have access to accurate information and fair treatment.

For instance, if you receive a faulty product, you have the right to a refund or replacement. If a service fails to meet agreed standards, you can seek redress. Knowing these rights can empower you. It can help you take action when necessary.

Resources for Reporting Scams

What do you do if you encounter a scam? Reporting it is crucial. Various resources are available for this purpose:

- Federal Trade Commission (FTC): The FTC handles complaints about deceptive practices.

- Consumer Financial Protection Bureau (CFPB): This agency focuses on financial products and services.

- Better Business Bureau (BBB): The BBB helps resolve disputes between consumers and businesses.

- State Attorney General’s Office: Each state has its own office to handle consumer complaints.

When you report scams, you contribute to a larger effort to protect others. Your experience can help authorities track down fraudsters.

Legal Avenues for Victims

If you’ve fallen victim to a scam, don’t lose hope. There are legal avenues available. You can file a lawsuit against the offending party. This process can be daunting, but it’s often necessary for justice. Many lawyers specialize in consumer rights. They can guide you through the legal process, ensuring your case is heard.

Additionally, class-action lawsuits can provide a collective way for victims to seek compensation. This approach can be more effective than individual lawsuits.

How Advocacy Groups Can Help

Advocacy groups play a vital role in consumer protection. They work tirelessly to inform and support consumers. Engaging with these organizations can provide you with valuable resources. They can help you understand your rights better and navigate complex situations.

For example, groups like the Consumer Federation of America and the National Consumer Law Center offer information and support. They provide updates on legislation affecting consumers. They also advocate for stronger consumer protections at the state and federal levels.

“Informed consumers are empowered consumers.” – Advocacy Group President

This quote emphasizes the importance of being knowledgeable. The more you know, the better equipped you are to protect yourself.

Staying Informed About Financial Regulations

Financial regulations are constantly changing. Staying informed is essential to protect your rights. Follow reliable news sources and subscribe to updates from regulatory agencies. Knowledge is power. Understanding the latest regulations can help you make informed decisions.

For instance, changes in credit reporting laws can affect your credit score. Being aware of these changes can help you manage your finances better.

Taking Control of Your Consumer Experience

Many consumers feel powerless during fraudulent situations. However, knowing your rights is the first step in gaining control. You are not alone. Resources are available to assist you. Engage with advocacy groups, report scams, and understand your legal options. Empower yourself with knowledge.

In the end, being an informed consumer is about more than just knowing your rights. It’s about taking action. It’s about standing up for yourself and others. By educating yourself and staying vigilant, you can navigate the marketplace confidently.

Remember, consumer protection is not just a personal issue. It’s a collective effort. By sharing your experiences and knowledge, you contribute to a safer marketplace for everyone. Don’t hesitate to seek help when needed. You have the right to be a safe and informed consumer.

Prevention: How to Avoid Funding Scams

When it comes to securing a loan, you want to ensure you’re making a wise decision. Unfortunately, funding scams are all too common. But don’t worry! There are steps you can take to protect yourself. Let’s dive into some practical tips that can help you avoid falling victim to these scams.

1. Red Flags to Watch for in Loan Offers

First things first, keep an eye out for red flags. These signs can help you identify a scam before it’s too late. Here are some key indicators:

- Unrealistic Promises: If a lender guarantees approval regardless of your credit history, that’s a major warning sign.

- High Fees Upfront: Be cautious if you’re asked to pay large fees before receiving any funds.

- Pressure Tactics: If they rush you to make a decision, take a step back. Legitimate lenders will give you time to think.

- Vague Terms: If the terms of the loan are unclear or confusing, ask for clarification. A good lender will provide clear information.

Remember,

“If it sounds too good to be true, it probably is.”

– Financial Consultant. Always trust your instincts!

2. Conducting Due Diligence

Next, you should conduct thorough due diligence. This means doing your homework before signing any agreements. Here’s how you can go about it:

- Research the Lender: Look for reviews online. Check their reputation on websites like the Better Business Bureau.

- Check for Complaints: See if there are any complaints filed against the lender. This can give you insight into their practices.

- Ask Questions: Don’t hesitate to ask the lender about their process. A reputable lender will be happy to answer your questions.

Doing this research may seem tedious, but it’s worth the effort. You wouldn’t buy a car without checking its history, right? The same goes for loans!

3. Importance of Transparency in Fees

Another critical aspect is the transparency of fees. A legitimate lender should clearly outline all fees associated with the loan. Here’s what to look for:

- Itemized Fee Breakdown: Ensure you receive a detailed list of all fees. If they’re vague, that’s a red flag.

- Reasonable Fees: Compare fees with other lenders. If one lender’s fees are significantly higher, question why.

- Clear Communication: Make sure the lender is willing to explain any fees that seem confusing.

Transparency builds trust. If a lender is upfront about their fees, it’s a good sign. You deserve to know exactly what you’re paying for!

4. Verifying Company Credentials

Before committing to a loan, it’s essential to verify the company’s credentials. This helps ensure you’re dealing with a legitimate lender. Here’s how to do it:

- Licensing: Check if the lender is licensed in your state. Each state has its own requirements for lenders.

- Contact Information: Make sure they have a physical address and a working phone number. Scammers often use fake contact information.

- Professional Affiliations: See if they belong to any recognized financial organizations. This can lend credibility.

Taking these steps may seem like a hassle, but they can save you from a lot of trouble down the line.

5. Seeking Second Opinions from Financial Advisors

Finally, consider seeking second opinions from financial advisors. They can provide valuable insights and help you evaluate your options. Here’s how to approach this:

- Find a Trusted Advisor: Look for a financial advisor who has a good reputation and experience in the field.

- Discuss Your Options: Share the loan details with them. They can help you understand if it’s a sound decision.

- Ask About Alternatives: A good advisor can suggest other options that may be more beneficial.

It’s always wise to get a second opinion. Just like you wouldn’t go into surgery without consulting a doctor, don’t make financial decisions without expert advice.

In summary, prevention goes a long way. The more informed you are, the safer your investments will be. If something seems off, don’t hesitate to ask questions or seek help. You have the power to protect yourself!

What to Do if You’re a Victim

Finding out you’ve been scammed can be a shocking experience. It can leave you feeling vulnerable and unsure of what to do next. But remember, you’re not alone. There are steps you can take to regain control and start your recovery process.

1. Immediate Steps to Take After Discovering a Scam

The moment you realize you’ve fallen victim to a scam, it’s crucial to act quickly. Here are some immediate steps you should consider:

- Stay Calm: Panic can cloud your judgment. Take a deep breath.

- Assess the Situation: Determine what information or funds were compromised.

- Disconnect: If you provided personal information over the phone or online, stop all communications immediately.

2. Contacting Your Bank and Law Enforcement

One of the first calls you should make is to your bank. They can help protect your accounts and may even assist in recovering lost funds. Here’s what to do:

- Notify Your Bank: Call your bank’s fraud department. They can freeze your accounts to prevent further loss.

- Report to Law Enforcement: File a report with your local police. This creates an official record of the scam.

- Contact Credit Bureaus: Consider placing a fraud alert on your credit report to prevent identity theft.

3. Keeping Records of Communications

Documentation is key in these situations. Keeping detailed records can significantly aid in your recovery process. Here are some tips:

- Log All Communications: Write down dates, times, and details of any conversations you have regarding the scam.

- Save Emails and Messages: Keep any correspondence related to the scam as evidence.

- Organize Your Records: Use a folder or digital file to store all relevant information in one place.

As a support specialist once said,

“Refrain from self-blame; focus on recovery and prevention.”

It’s important to remember that being a victim does not define you. Recovery is possible.

4. Reaching Out for Emotional Support

The emotional toll of being scammed can be heavy. Don’t hesitate to reach out for support. Here’s how:

- Talk to Friends and Family: Share your experience with trusted loved ones. They can provide comfort and understanding.

- Seek Professional Help: If you’re feeling overwhelmed, consider speaking with a therapist or counselor.

- Join Support Groups: Look for local or online support groups for scam victims. Connecting with others who understand can be incredibly healing.

5. Resources for Financial Recovery

Recovering financially from a scam can be a daunting task, but there are resources available to help you:

- Financial Advisors: Consult a financial advisor for guidance on managing your finances post-scam.

- Consumer Protection Agencies: Reach out to organizations like the Federal Trade Commission (FTC) for advice and support.

- Credit Counseling Services: These services can help you understand your financial situation and create a recovery plan.

Victim recovery pathways are often available. Community support can help during tough times. Remember, there’s no shame in being a victim. With the right steps, you can rebuild and protect yourself from future scams.

In the aftermath of a scam, the road to recovery may feel long, but each step you take is progress. Focus on what you can control, and don’t hesitate to ask for help. You are not alone in this journey.

Conclusion: The Bigger Picture

As we wrap up our discussion, it’s essential to take a step back and reflect on the practices of Kennedy Funding. Investing can often feel like a maze, where every turn might lead to a new opportunity or a potential pitfall. Have you ever wondered how to discern between the two? That’s where understanding the practices of companies like Kennedy Funding comes into play.

Reflecting on Kennedy Funding’s Practices

Kennedy Funding has been a topic of conversation among investors. Some praise their innovative funding methods, while others voice concerns about transparency. This dichotomy is important to consider. When you invest, you are not just putting your money on the line; you are engaging with a system that can significantly impact your financial future. Reflecting on these practices allows you to make informed choices. Always ask yourself: Is this company aligning with my investment values?

Balancing Risks with Potential Rewards

Every investment carries risks. It’s a fundamental truth. But what about the rewards? Balancing these two aspects is crucial. Think of it like riding a bike. You need to maintain your balance to avoid falling. Similarly, when investing, weigh the potential gains against the risks involved. Consider asking yourself: What am I willing to lose for a chance at greater rewards? This mindset can guide your decisions and help you navigate the investment landscape more effectively.

The Importance of Informed Decision-Making

Knowledge is power when navigating investment opportunities. This quote from a financial educator rings true. Informed decision-making is the bedrock of successful investing. You might find it beneficial to research companies, read reviews, and consult financial experts. Don’t be afraid to ask questions. What do others say about their experiences? Engaging in discussions can provide insights that numbers alone cannot. Remember, being informed means you are empowered.

Encouraging Community Support Among Investors

Investing does not have to be a solitary journey. Building a community can enhance your experience. When investors come together, they share knowledge and experiences. This support system can be invaluable, especially when navigating the tricky waters of investment. Have you considered joining forums or local investment groups? These platforms can offer a wealth of information and camaraderie. Together, you can discuss challenges and successes, bringing clarity to your investment decisions.

Final Thoughts on Financial Empowerment

Ultimately, financial empowerment is about making choices that align with your goals. Investing is a journey, and having a support system significantly improves outcomes. It’s not just about the money; it’s about gaining confidence and understanding in your financial decisions. Encourage open dialogues about experiences, as they promote visibility of scams and help others avoid pitfalls. Have you shared your investment story? Your experience could guide someone else.

As you reflect on your investment choices, consider not just the options before you but the network of support that can guide your decisions. Financial empowerment is within your reach. By staying informed, balancing risks, and fostering community support, you can navigate the investment landscape with confidence.

“Knowledge is power when navigating investment opportunities.” – Financial Educator

In closing, remember that the world of investing is complex but manageable. With the right mindset and support, you can achieve your financial goals. So, are you ready to take the next step in your investment journey? The bigger picture is waiting for you.